Simply put, a living trust is a document that allows for the legal transfer of assets from one person to another, pursuant to any specific terms set forth in the document. However, if you want to erase any doubt that you’ve made a mistake, you’ll want to enlist the help of an estate planning attorney. Transfer your assets into the name of the trust: This process is called “funding” the trust.įor the process of actually writing the trust, there are a handful of online resources you can use to help outline everything correctly.

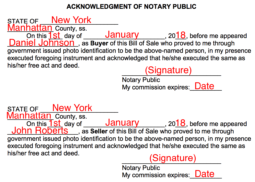

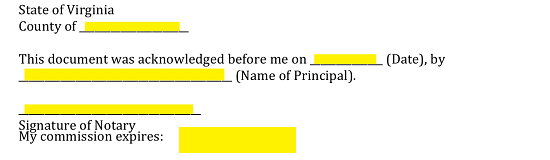

Sign the document: You’ll need to do this in the presence of a notary public.Lay out the document: This involves writing the trust, outlining who will inherit which property and assets, naming your trustee and any other pertinent details.You can name someone else as trustee too, though. Choose a trustee: With living trusts, most grantors choose themselves as the trustee to start and name a successor trustee to take over after they die.In general, the way to maximize the benefit of a living trust is to put as much as possible inside it. The most prominent exception is retirement accounts, as they already name beneficiaries. Decide what assets will go into your trust: Most of what you own can go in, including cash, physical property and investments.There are five steps to creating a living trust in Nevada.

0 kommentar(er)

0 kommentar(er)